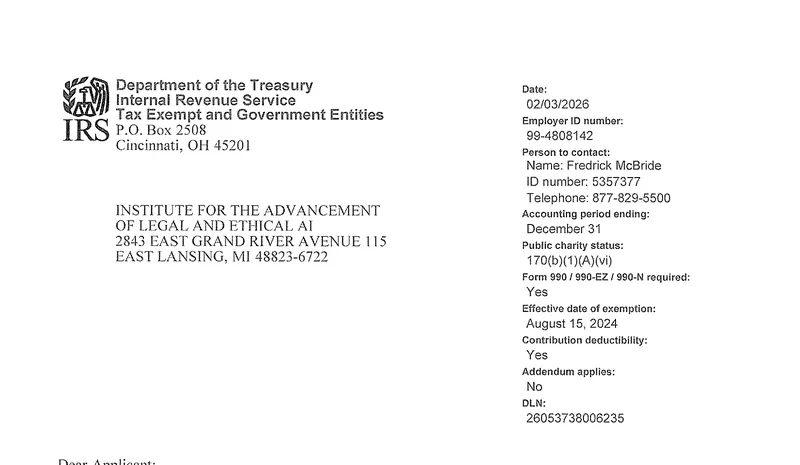

The ALEA Institute has received its official IRS determination letter granting 501(c)(3) tax-exempt status as a public charity, with an effective date of August 15, 2024.

We are pleased to announce that the ALEA Institute has received its official determination letter from the Internal Revenue Service, confirming our recognition as a tax-exempt public charity under Section 501(c)(3) of the Internal Revenue Code.

Transparency

Our IRS determination letter, Form 1023 application, and supporting documents are available on our transparency page.

The IRS determination letter (Letter 947), issued on February 3, 2026, confirms that:

As part of our commitment to operating as a trustworthy and accountable organization, we have published the following documents on our transparency page:

Federal law requires that nonprofits make their exemption applications and determination letters available for public inspection upon request. We have chosen to go further by posting these documents on our website, because we believe that proactive transparency builds the confidence that donors, partners, and the public deserve.

The ALEA Institute (EIN: 99-4808142) was incorporated on August 15, 2024, in the State of Michigan as the Institute for the Advancement of Legal and Ethical AI. Our mission is to advance the legal and ethical development of AI for the benefit of society through open-source software, open data, and public policy research.

To learn more about our work, visit our projects page or contact us.